A strong track record.

And we are only just beginning.

million dollars

370

$ value of assets under management

Units under management

~1500

1.4mm SF of commercial space 15+ acres of developable land

million

~1.1

square feet

Representative Projects

Value is our common denominator.

A sample of our projects that showcase the execution of our strategies.

Charleston MSA, SC

West Ashley

West Ashley Portfolio, a 498-unit, 3-property portfolio consisting of Ashford Palmetto Square, Ashford Riverview, and Radius at West Ashley. Located in the Charleston MSA, the West Ashley submarket exhibits strong renter demographics and central location only 5 miles from Historic Downtown Charleston. One of the fastest growing metros in the US, Charleston continues to grow and attract a highly educated and skilled workforce with the expanding Digital Corridor and Fortune 500 area developments. The property was acquired for 76 million.

-

Purchase Price: $76,000,000

This deal merged the assets of four different sellers to assemble 15 parcels with 30 garden style apartment buildings totaling 342 existing and 40 future apartment units. The result will be one of the largest (by way of acreage) contiguous garden style communities in the City of Atlanta. When complete the property will be highly amenitized with grilling stations, three dog parks, a lounge, pool, and an additional 40 units.

At the early stage of this project we are achieving rents of ~$200 above pro forma on our renovated units without completing a significant amount of our common area capital improvements.

This success has not gone unnoticed by the market as we have had unsolicited offers of $30k/unit more than we originally paid.

-

Purchase Price: $42,855,000

-

CapEx Invested: $4,500,000

-

Current Value: $80,000,000

This project, located in the heart of Midtown just steps away from Piedmont Park, was purchased for $1.6mm. Upon acquisition it was comprised of 12 one-bedroom/one-bathroom apartment units whose configuration and condition were a nod to their 1920s vintage. Our team de-leased the property, gutted it down to the studs, dug out the basement, replaced the roof and mechanical systems, and rebuilt the property at a budget of $70k/unit to have a total unit count of 24 modern studio and one-bedroom units.

The project’s common areas were inspired by the thought of what a modern-day Studio 54 would look like. This was achieved through the works of a local artist and fixtures sourced by the team. The units’ interiors featured modern architectural and technological touches that appeal to today’s renter. As a result, Studio9Forty was able to lease up in under two months, achieve some of the highest rents/sf in the Atlanta market at $3.06/sf, and refinance our LPs out for an IRR of 110%+.

-

Purchase Price: $1,650,000

-

CapEx Invested: $1,800,000

-

Current Value: $6,300,000

Enclave at Peachtree Memorial was one of the first apartment-to-condo conversion projects in Atlanta since the last housing boom. Nestled on the quiet Peachtree Memorial Drive off one of Atlanta’s busiest thoroughfares, Peachtree Street, between Atlanta’s two major submarkets of Buckhead and Midtown.

The project was purchased for $10mm on November 2018 and consists of 50 units. Upon renovation, the unit mix is 100% 2 bedrooms/2 bathroom condos ranging in size from 821 sf to 1,357 sf priced from the low $300,000s to the mid $400,000s. The project’s grand opening saw tremendous success and sold 12 units within the first month.

After acquiring the project, we found the ability to add an additional ten townhome lots in front of the buildings 58, 68, & 78. The townhome lots are currently on the market and have a cumulative list price of $1.5mm; a profit that was not in the original proforma.

-

Purchase Price: $9,043,000

-

CapEx Invested: $3,500,000

-

Current Value: $19,788,312

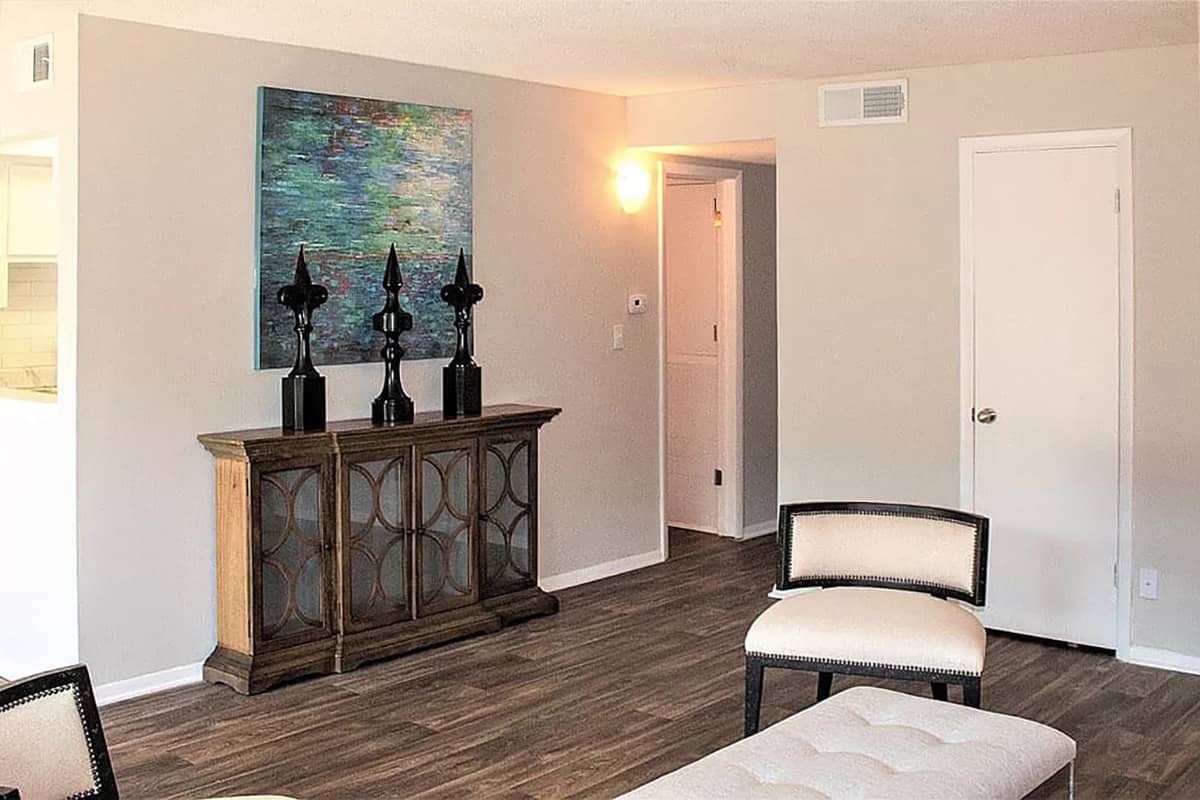

A 60-unit apartment community located in Las Vegas; this is the first deal purchased outside of the Atlanta market for our group. The property was purchased for $85k per door, which was well below market at the time. We are currently renovating the property based on a more modern aesthetic loosely based on The Hollywood Roosevelt look for the exterior.

The Las Vegas market was one of the hottest markets in the country for multifamily and had the second highest rent growth year over year in the country of about 4.6% in 2019. Prior to beginning renovations we were able to lease the first vacant unit at our proforma rate supporting our thesis that there was a higher rate ceiling than modeled. We have since renovated 31-units and are getting $150+ per month above pro forma rents.

-

Purchase Price: $5,060,000

-

CapEx Invested: $491,000

-

Current Value: $8,100,000

This portfolio of three multi-family communities totaling 103 units located in the highly desirable city (and school district) of Decatur was purchased for $16mm. Upon acquisition, our team began renovating one of the communities from a worn C-Class apartment to a revitalized and artful B-Class apartment rebranded as “Camellia Decatur”. The repositioning of these 66 two bedrooms/one bathroom units totals just $20k per unit, which includes the common area and exterior improvements and is 20% under the pro forma budget.

The other two communities, which are in the Oakhurst section of the City of Decatur, are a higher zoning of RS-17 allowing for 17 units to the acre. Thus, one site would yield 17 and 35 units. Since the zoning is based on units, and units are based on the number of kitchens, we are formulating a ground up development concept around co-living with an average of 4 bedrooms per unit or 140 rooms on one site and 68 rooms on the other. The returns on this type of project are far exceed the original underwriting to do traditional value-add apartments.

-

Purchase Price: $16,000,000

-

CapEx Invested: $1,435,000

-

Current Value: $22,250,000

This Mixed-Use asset combines two retail spaces and 14 apartment units and is the quintessential “covered land play”. The asset is in the heart of Midtown Atlanta in a location that the future land use plan allows for high rise development. Our team was able to acquire the property based on in-place cash flow and re-tenanting the basement and first floor retail spaces in conjunction with renovating the 14 residential units on the top two floors. Both retail spaces are nearing completion of their buildouts and should be open by summer. The residential units have been fully leased since a month after renovations completed in Spring of 2020.

-

Purchase Price: $6,700,000

-

CapEx Invested: $850,000

-

Current Value: $10,000,000

This highly coveted property was owned by the same family for over 100 years. It was not until recently that the property came available and found its way into our portfolio. Upon acquisition the .73-acre site houses 26-units (including two servants’ quarters) with, “expansive view corridors in every direction” as touted by brokers and Curbed Atlanta. The plan is to renovate to 48 micro and one-bedroom units. The property was originally built in 1930 and is one of the last remaining original garden style apartment complexes with parking garages. We planning to put The Winnwood on the National Historic Registry to receive Historic Tax Credits for interior and exterior renovations.

-

Purchase Price: $4,600,000

-

CapEx Invested: $7,293,329

-

Current Value: $15,000,000